Understanding The Different Uses Of Quick Personal Loans

The internet is filled with personal loan app options, and almost everyone is using them these days. Some use it for their business, and some use it for shopping, traveling, or other reasons. If you have just heard about the concept of personal loans and thinking of getting one, you must know some of the top reasons why people take a personal loan.

Here are a few top reasons for taking a personal loan:

- Debt Consolidation

Debt consolidation is a commonly adopted strategy using personal loan funds, especially among individuals grappling with high-interest credit card debt. Through this approach, borrowers can secure a fixed interest rate and a structured repayment plan, ultimately facilitating the complete settlement of their combined debts. The potential savings for a borrower opting for debt consolidation hinge on factors such as the existing debt amount, prevailing interest rates on current loans, and the monthly repayment capacity.

- Moving Expenses

The costs associated with moving can fluctuate based on the distance of the move, the volume of belongings, and the level of assistance required. For instance, hiring movers to pack all your possessions incurs higher expenses compared to seeking professional help specifically for moving furniture and bulky items. Regardless of the specific moving requirements, an appropriate quick loan enables you to borrow a sum aligned with your needs.

- Medical Expenses

Rapidly accumulating medical expenses can pose a significant burden, and managing long-term medical debt is a priority for many. Utilizing a personal loan offers the potential to consolidate and effectively address medical debt and various healthcare-related costs over an extended period.

It’s essential to note that most medical debt typically does not accumulate interest, emphasizing the need for careful consideration before opting for a loan. While consolidating medical debt into a single payment may enhance bill management, it tends to be costlier than directly settling the bills. Additionally, exploring negotiations with medical creditors to reduce the owed amount is advisable. Having funds from a loan may also present the opportunity for cash payments, often attracting discounts from providers and mitigating the interest costs associated with the personal loan.

- Large Purchase

Whether you’re looking to fund a new set of living room furniture or intend to embark on an anniversary vacation, if you lack the immediate cash for upfront payments, a personal loan offers a solution to borrow funds with clear terms, eliminating uncertainties regarding owed amounts and debt-free timelines. Furthermore, as highlighted earlier, opting for a personal loan for substantial expenses typically results in a more favorable interest rate compared to using a credit card.

Conclusion: The Bottom Line

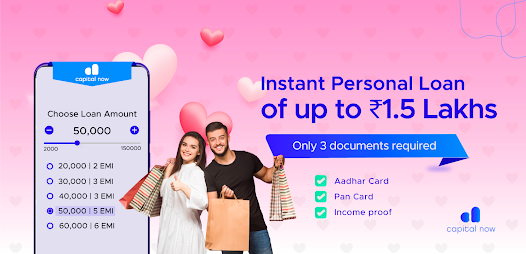

Personal loans can be used in various ways, but it is always good to know the top reasons before applying for one. If your reason for taking a quick loan online matches with the ones stated above, go ahead and apply for one using an instant loan app. The application will be accepted in minutes with minimum paperwork. Adding to that, no extra collateral fee is required. However, remember to pay the EMIs on time.