How Instant Loans Are Reshaping The Personal Finance World?

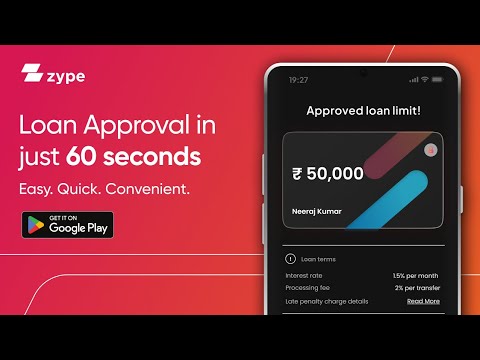

The request for instant gratification has penetrated different viewpoints of our lives, counting individuals back. The rise of instant loans is revolutionizing how people get to reserves, offering comfort and easy access. Let’s dig into how these fast budgetary arrangements are reshaping the scene of the personal finance world. We will understand how loan EMI calculator are also being used when offering instant loans, and so much more today in this article.

1. Instant Access to Funds

Gone are the days when people had to persevere with long application forms and hold up weeks for loan approvals. Instant loans, accessible through online stages and portable applications, give borrowers a quick get to reserves. Whether confronted with a startling cost or seizing a time-sensitive opportunity, these credits offer a life saver, guaranteeing that monetary needs are met expeditiously. Another comfortable approach towards personal finance is the concept of online shopping in EMI, where customers can now buy whatever they want and pay in installments, similar to instant loans.

2. Simplified Application Procedures

Gone are the days when people had to persevere with long application forms and hold up weeks for loan approvals. Instant loans, accessible through online stages and portable applications, give borrowers a quick get to reserves. Elven loan providers now use technology based loan calculator to create the perfect installment system that aligns with the borrower’s credibility. Whether confronted with a startling cost or seizing a time-sensitive opportunity, these loans offer a life saver, guaranteeing that budgetary needs are met instantly.

3. Flexibility and Convenience

The adaptability advertised by instant loans is unparalleled, catering to assorted money-related needs and circumstances. Whether looking for short-term payday loans or a more amplified reimbursement term, borrowers can select alternatives that adjust with their inclinations. Besides, the comfort of getting to these loans anytime, anyplace, enables people to explore money-related challenges quickly. The advanced change of loaning guarantees that borrowers have unparalleled comfort at their fingertips.

4. Mitigating Financial Emergencies

Financial emergencies come without warning, necessitating immediate intervention. Instant loans serve as a vital resource during such crises, enabling individuals to address urgent expenses promptly. Whether confronting medical bills, vehicle repairs, or unexpected home repairs, these rapid financial solutions offer timely assistance. The ability to secure funds swiftly alleviates stress and provides peace of mind, ensuring that unforeseen challenges are managed effectively.

5. Enhanced Accessibility

The democratization of lending facilitated by instant loans enhances accessibility for a broader spectrum of individuals. Traditional lending institutions often impose stringent eligibility criteria, excluding many from accessing financial resources. In contrast, instant loan India embraces inclusivity, catering to individuals with varying credit profiles. The expanded accessibility ensures that more people can leverage these financial tools to fulfill their needs and aspirations, fostering economic empowerment and resilience.

6. Digital Innovation Driving Change

The multiplication of advanced innovation could be a foundation of the instant loan transformation. Inventive fintech companies tackle the control of innovation to streamline loaning forms, optimize chance appraisals, and improve client encounters. Progressed calculations encourage quick assessments, empowering real-time loan endorsements and distributions. The collaboration between advanced development and budgetary administrations is reshaping the individual back scene, introducing it in a time of unparalleled comfort and effectiveness.

Conclusion:

The development of instant loan assist is changing individual funds, advertising speed, comfort, and adaptability to borrowers around the world. By prioritizing openness, rearranging application strategies, and leveraging advanced development, these quick monetary arrangements address advancing customer needs and inclinations. As the budgetary scene proceeds to advance, instant loans will remain an urgent constraint, reshaping how people get to reserves, oversee crises, and explore their monetary ventures. Grasping these progressions mindfully can enable people to realize their objectives and yearnings, leveraging the benefits of instant loans while keeping up budgetary well-being.